Hype Aside, How is AI Actually Impacting Sports?

Hype Aside, How is AI Actually Impacting Sports?

We spoke with league and team executives to learn what AI applications they're most excited about

October 2025

If you’re a sports fan, you’ve seen the AI commercials.

The NFL and Microsoft Copilot are helping coaches make on-field decisions with AI. The NBA and AWS are bringing AI-powered advanced stats to fans. The MLB and Google Cloud are using AI to engage consumers better in stadiums.

As a fan, it’s near-impossible to know what all this AI talk actually means – versus what’s just Big Tech spending on brand marketing.

It’s hard to know what’s real versus what’s hype.

As an investor, it’s a pretty similar experience. At Will Ventures, we’re confident that AI will significantly impact the sports industry, like most industries. But we’re also aware that many AI applications are either overhyped or too early to invest.

So we spoke with several dozen executives at major sports leagues and teams to understand what AI tools they’re actually using today. (We focused our conversations on off-field rather than on-field applications, which are a whole different ballgame).

We think there are several reasons that AI will impact the sports industry even more than other industries.

First, the sports industry’s largest revenue driver is content – and AI video & image models will transform content creation and consumption habits. (We wrote a longer essay on that here).

Second, the sports industry is really just a collection of small- and mid-sized businesses – i.e. the teams – which hire for dozens of roles that can be automated or supercharged by AI.

Third, sports properties have some of the richest consumer datasets – spanning tickets, merchandise, content, gaming and more touchpoints – which can be used to predict preferences and engage fans better.

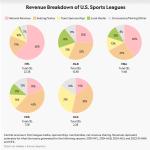

As a proxy for where AI can drive the most value, it’s helpful to look at how sports leagues make money. Leagues have four main revenue buckets:

- Media

- Ticketing & Gameday

- Sponsorships

- Merchandise & Licensing

Some leagues index more on certain buckets. For example MLB is more of a ticketing-driven business, while the NFL’s more media-driven. But all leagues have more or less the same software needs across these buckets, and therefore the same AI use cases.

All that said, there are reasons to be skeptical of AI startups selling into sports.

As has been well-reported, 95% of enterprise Gen AI pilots are failing. This wouldn’t be the first time a tech hype cycle took the sports industry by storm. Remember when NFTs were going to revolutionize the fan experience, or when VR was going to reimagine live game viewing?

It’s also clear that AI giants like Google and Microsoft (which already have existing sports partnerships) will capture a lot of value that new startups won’t. We still don’t know which use cases will be served by ChatGPT vs a new vertical-specific application.

Nevertheless, here’s the hardest part of investing in AI startups selling into the sports industry: underwriting outcomes to venture-scale.

We’re confident that many AI startups will successfully sell point-solutions into leagues and teams. But in order to reach venture-scale – think a multi-billion dollar enterprise value – a startup would need to either:

1) drive massive value-add for their sports customers, or

2) use sports as a beachhead to expand into larger, adjacent industries

With that lens, we spoke with league and team executives. Coming out of those conversations, here are four AI applications they’re most excited about as operators and we’re equally excited about as investors.

Theme 1: Media Production

Sports properties and their broadcasting partners have huge content production needs – and the explosion of short-form video and international content has only increased those needs.

Platforms like Greenfly and ScorePlay are already automating large parts of the media workflow, helping to ingest raw game footage, tagging key moments using computer vision, and directly publishing short and long-form media. Both sports-specific tools like Magic Hour and generalist tools like Midjourney are also being used for design inspiration and special effects.

Simultaneously, in 2025 every sports property is looking to expand their fanbase internationally. International games have become a core part of this strategy. Just this season, the NFL will play games in Brazil, Ireland, Germany, Spain and the UK. But the truth is the NFL will drive the bulk of its engagement through content that speaks to local fans who won’t attend the games in-person.

The challenge with localized content is it’s time-intensive and expensive. If the NFL wants to post Portuguese highlights on its YouTube, it needs to hire local commentators, rent a studio, and pay a production team. And that’s all just for one language. Furthermore, monetization in these countries hasn’t yet scaled and leagues like the NFL struggle to invest in content production with limited ROI.

Recently AI startups like LingoPal and Camb.AI have begun offering real-time content translation specifically for sports use cases. Outside of sports, Eleven Labs has built a significant content dubbing business for premium IP holders. Of the dozens of sports executives we spoke with, real-time translation was one area they were most excited about.

With this technology, an English sports broadcast can plug into their API and get a broadcast translated into another language with near zero latency. This is a really tough technical challenge. Ideally translation shouldn’t just be real-time. It should also be emotionally-aware and context-based. For example, if an American commentator screams “Mahomes is crushing it” the model must know how to capture that vernacular and tone and translate it to multiple languages.

In addition to these real-time translation tools, leagues are also increasingly interested in dubbing and closed captioning tools. Together, these tools are critical to grow international viewership and fan development.

Theme 2: Sponsorship

Sponsorship is another major revenue driver for sports properties, who hire large partnership sales and activation teams. The sponsorship sales motion in particular is slow and analog. Teams spend weeks putting together lists of prospects, doing cold outreach, and manually building pitch decks.

AI tools can’t replace these teams entirely. Sponsorships are often multi-million-dollar deals that include different ad inventories & VIKs, which requires a human in the loop. But sports properties could use copilots for sponsorship sales. Imagine a tool that could ingest first-party fan data, triangulate which brands are the closest demographic fit, and contact the CMOs of which brand with a customized pitch deck.

Some of this is already happening. For example, CRED is working with multiple NBA and European soccer teams to combine their internal and external data, provide a new CRM for sponsorship sales, and automate outreach to brands. Wolfcycle is helping multiple teams qualify high-quality leads for sponsorship and premium ticket sales.

If a startup can nail sports sponsorship workflows, they could leverage the same tech to expand into other industries. Music festivals, trade shows, media companies, and live experience businesses (e.g. casinos and theme parks) all have similar sponsorship sales functions.

Theme 3: Ticketing

For the NHL, MLB, and MLS, ticket and suite sales are the largest revenue driver. Despite this, teams’ sales functions have seen remarkably little tech innovation. Most teams still rely on large, commission-driven sales teams making cold calls, manually qualifying leads, and logging activity in outdated CRMs.

Several teams we spoke to have begun experimenting with AI-powered sales tools. Some are running pilots with industry-agnostic tools like Bland AI to automate sales outreach. These teams are using AI agents to handle initial touchpoints, while human reps can still focus on closing sales. Some more sophisticated teams are actually building their own internal copilots that can handle things like lead scoring, campaign automation, and retention.

Data enrichment, in particular for season ticket and suite sales, is another area we’ve seen innovation. For example, Minerva has helped the Miami Dolphins, F1 and other sports properties build datasets of potential high-value customers, thereby making sales outreach more effective.

When discussing ticketing, it’s also mandatory to mention that the entire experience is fundamentally broken for fans. With Ticketmaster controlling most venues, fans have to pay high (and hidden) fees. They also don’t get engaged in any personalized way. Ideally fans should get personalized pricing options, seat upgrade and merchandise offers, and personalized notifications in their app. But Ticketmaster’s legacy tech stack fails to leverage fan data and leaves fans treated like anonymous transactions rather than valued members of a community.

Jump, a Will Ventures portfolio company, is building an entirely new, AI-native tech stack. Jump’s vision is to unify fan data, team ticket inventory, and team CRM in one-place. Instead of a general transactional checkout page, you can imagine an AI that might know your past attendance, budget, favorite player, etc. and proactively offer you the best ticket for you. Over time, this AI could even automate some of the sales process. We’re excited for Jump’s launch with the Minnesota Timberwolves this season.

Theme 4: IP Management

The last category we’ve seen sports executives most excited about is IP management. As we wrote about in depth in “The NBA x Open AI deal,” athletes, leagues and teams are increasingly seeing their IP appear in AI-generated content. They’re eager for tools to both protect and monetize their IP in this new age of AI content creation.

We’ve seen several startups help IP holders monitor unwanted AI-generated content online and issue takedown notices to social media platforms. For example Loti provides this service for celebrities including Keanu Reeves.

However, as AI models continue to improve, we could see a near-future where it’s almost impossible to identify AI-generated content vs real content. We believe the larger, longer-term opportunity is in helping IP holders manage and monetize their IP via AI content.

Jake Paul’s activity on Sora in the few weeks is an interesting case study. Paul (who’s an investor in OpenAI) encouraged fans to use his likeness in Sora videos and got significant engagement on the platform. See below the engagement results he posted on X.

Also check out how Mark Cuban used Sora to drive awareness around his low-cost prescription drug company.

Leagues, teams, and individual athletes can start licensing their archives and likeness in entirely new ways. Imagine a world where creators on Sora and Veo can legally generate derivative content built on official licensed footage – and sports properties get compensated for every usage. This model could work across verticals – not just sports but also music, TV/film, and other IP.

To recap, there’s a lot of hype around AI startups selling into the sports industry. But there are multiple ways that this technological platform shift is already impacting the space – from media production to ticketing to sponsorships to IP management.

If you’re excited about AI’s impact on the sports industry – and building around any of these four areas or others – we’d love to hear from you!