India: The Next Frontier in Sports and Media

(Part I)

India: The Next Frontier in Sports and Media

(Part I)

The next $1B+ sports, media, and entertainment business will be built in India.

June 2025

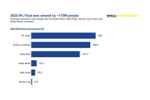

Last month, a record 169 million Indian fans watched the IPL final between Royal Challengers Bengaluru (RCB) and the Punjab Kings. The final was the most-watched cricket match in Indian television history.

The match was viewed by more people than the Super Bowl, NBA Finals, Stanley Cup Finals, and World Series combined.

Note: World Series, NBA Finals, and Stanley Cup are averages of series

Source: Will Ventures analysis; League-reported data; Nielsen

This milestone is more than just a reflection of cricket’s dominance. It is a signal that India is capable of supporting scaled, world-class businesses in sports, media, and entertainment. While much of the value created to date has concentrated around cricket, there are clear indicators that the broader landscape is evolving.

A few long-term trends excite me about India’s potential:

- India will have 900 million internet users in 2025 - this number is growing by 10% every year

- India’s middle class is expected to grow from 30 percent of the population today to 60 percent over the next 2 decades

- More than 40 percent of Indian sports fans are Gen Z, mostly consuming sports content digitally

Source: Deloitte / Google Unlocking India’s $130B Sports Potential

Now, India is not without its challenges. There are several challenges that investors, operators, and founders must contemplate:

- Over-concentration on cricket: Cricket drives ~85% of domestic sports sponsorship revenue and media coverage. Other sports are underfunded and have minimal exposure

- Monetization: ARPU numbers in India are weaker relative to other countries, given lower household income. Users are less willing to spend on subscription while ad monetization is much lower than in Western markets.

- User retention and engagement: Given the myriad of entertainment options, new apps often see an initial spike in users but then struggle with retention. Content fatigue is a real-risk as users quickly grow tired of repetitive or low-quality content. While this is not unique to India, India’s LTV being lower than other markets makes retention more important

- Regulatory and legal risks: The policy environment can change quickly in India with shifts in political party. Recently, for example, real money fantasy sports and online gaming startups have faced increasing regulator scrutiny, including a new 28% GST tax.

Despite these hurdles, several companies have shown that leading businesses can be built in sports & media in India. In just the past few years, we’ve seen major successes across categories:

- Fantasy Sports: Dream11, India’s leading real money fantasy sports platform, raised $840M in 2021 at a $8B valuation. As of FY 2023, the business generated $750mm+ of revenue and was profitable

- Media and Apparel: FanCode, a sports streaming and commerce company, raised $50M in 2021 from parent company Dream Sports

- Music: The 2018 merger between Jio Music and Saavn created a $1B+ subscription music product similar to Spotify

- Live Events: BookMyShow, an online platform for ticketing purchases, raised $100M from TPG Growth in 2018 and has reportedly had discussions with KKR on a minority investment between $250-$300M

These outcomes provide an extremely strong foundation for the next wave of builders. Looking ahead, I believe four areas will drive the next phase of growth in Indian sports and media.

- Emerging sports leagues

- Recreational participation in sports

- A new generation of media companies

- Gaming and fantasy sports platforms

This article will focus on the first two: the rise of new domestic leagues and recreational participation in sports. In Part 2, I will explore innovation across media, gaming, and entertainment.

1) Emerging Sports Leagues

The IPL has arguably been the most successful launch of a new sporting league ever. The success of IPL creates a very compelling model for other emerging sports leagues to consider in India.

Now re-creating the success of the IPL isn’t easy - if it were, several of the other emerging sports leagues that have started in India would have fared better. The IPL had 3 major things going for it:

- Star Power and Entertainment Value: The IPL was immediately able to attract Bollywood celebrities like Shah Rukh Khan and Preity Zinta who immediately put the league onto the map. The level of buy-in these owners brought will be tough for other leagues to replicate. The IPL was also one of the first leagues in India to merge sports & entertainment, incorporating Bollywood celebrities, music, and cheerleaders for the first time.

- Innovative Format: The IPL was launched in part to grow the game of T20 cricket in India. A more dynamic, fast-paced (20 overs vs. 50 overs), and accessible form of cricket capitalized on a built-in audience and grew it significantly. This format allowed for matches that were more engaging and also better suited for broadcasting.

- Day 1 Commercial Model: The IPL had a very thoughtful franchise structure, immediate media rights deals, and built-in brand sponsorships that created a profitable business model quickly. Coupled with deep-pocketed ownership groups, the IPL was able to create a sustainable economic structure almost instantaneously.

Despite the unique factors that led to the IPL’s explosion (highly recommend the Acquired Podcast on IPL’s origin), I think some of that success can be replicated. Nearly 20 years after the IPL was first founded, I think it is time for India to create the next great domestic sports league.

Any successful new league in India will need to approach things a little differently. To that end, I believe the next generation of successful Indian sports leagues will share three characteristics:

- Digital-focused distribution: Given the scale of India’s digital audience, especially on platforms like YouTube, it is important to optimize for maximum distribution and not keep content behind a paywall or on legacy broadcast distribution. This means making all media free-to-air, including full matches, behind the scenes content, and original series related to players.

- Innovative formats focused on virality and gamification: Similar to how the IPL spearheaded a new cricket format, new leagues will need to optimize for shorter matches (designed for shorter attention spans) with entertainment at the forefront of gameplay, while not compromising competition.

- Leverage celebrities & creators to drive awareness: New leagues will need to tap into existing fanbases of Bollywood stars, YouTube creators, and other influencers to generate early momentum. Having them as owners and ambassadors for these leagues will allow for cross-promotion and drive awareness and distribution from day 1.

Here are 2 thought-starters I have for Indian sports leagues (would love to hear what new leagues in India would excite you):

- Creator driven cricket league

- A new combat league (MMA, Kabaddi, etc.)

Creator Driven Cricket League

As mentioned earlier, YouTube is India’s biggest media platform (500M MAUs, 120M DAUs averaging an hour a day on the platform). The proliferation of YouTube has created a network of top digital creators and influencers - many of whom are already massive sports fans.

While the IPL has innovated on the game of cricket, it is still only a 2 month tournament aimed at existing cricket fans. The popularity of cricket is actually declining among younger fans (a 2020 survey showed that only ~30% of Indians under 25 are very interested in cricket), many of whom are used to consuming media in new formats.

A shorter format cricket league that is owned and operated by India’s top digital creators and influencers would solve some of these issues. Imagine a 6-8 team league with matches optimized for digital-first consumption. Teams would be run by India’s biggest YouTubers and Bollywood stars, which would allow for built-in distribution and engagement.

With creators serving as team owners, match commentators, and league marketers, the league would be an intriguing blend of competition and entertainment. The league could further innovate on format, reducing to 10 or 15 over matches with modified rules and gamification, similar to what Kings League has done in soccer in Spain and around the world.

The league could air for free on YouTube, maximizing distribution for an audience that is hesitant to pay for content. This would also maximize commercial and sponsorship potential.

Obviously, the tradeoff between quality of play and entertainment value would be critical for an Indian audience where cricket is taken seriously. However, if a league is able to land on the right mix, it will be able to unlock a new generation of Indian fans and potentially expand geographically into other markets where cricket is popular or growing - think other parts of Asia, UK, Australia, South Africa, and the Middle East.

Emerging leagues have been targeting new generations of fans: TGL in golf, Kings League in soccer, The Snow League in winter sports. Similarly, a creator-owned cricket league that merges entertainment and competition can be India’s next big sports property.

A new combat league (MMA, Kabaddi, etc.)

There has been growing interest in combat sports across India, especially among younger male consumers. This momentum is real and has been driven largely by support from major Bollywood actors and creator involvement.

Still, this growth must contend with the fact that combat infrastructure is lacking in India, including a lack of gyms (MMA gyms only present in major markets), minimal government support, and grassroots interest paling in comparison to other sports. Furthermore, there have been no big Indian MMA stars, which historically has been a leading indicator of whether a country will become fanatical about MMA.

Regional properties like ONE Championship have tried to make inroads in India, but they have struggled to create local interest. This is primarily due to a lack of buy-in from regional athletes, a cultural connection, and grassroots infrastructure.

While many of these issues need to be solved, I think creating a new combat sports entity that combines Kabaddi, MMA, and other combat sports is interesting. A new league could build on the Pro Kabaddi League’s franchise model (built around regional teams in underserved markets) and layer in athlete and creator ownership, a hyperlocalized marketing strategy, and a focus on digital-first, viral content..

Imagine a league that heavily involves Bollywood celebrities, other prominent Indian athletes and top creators. The league could consider a team-based format anchored around regional cities in India, with each team having athletes competing in MMA, Kabaddi, and other sports. The league, similar to the IPL, would operate on a tight 2-3 month season which would maintain interest and allow top athletes to compete around the world. Finally, similar to the new cricket league I proposed, this league should be free on YouTube vs. behind a PPV paywall. Monetization should focus on sponsorships and advertising, with initial funding coming from team sales and naming rights.

This league would build on the popularity of Kabaddi and growing interest in other sports like MMA. Leveraging the deep history of combat sports in India, I think this new league could generate significant early momentum, especially in Tier 2 Indian Markets that have been neglected in professional sports.

While mass fandom through new leagues can power the flywheel, recreational participation is essential to building the sports base in India. That is why tools, platforms, and infrastructure that increase participation in sports in India are so necessary.

2) Recreational participation in sports

Participation in sports across India has grown rapidly, especially among younger generations. Disposable income has increased, health and wellness have become more mainstream, and new government programs have been established to drive more sports participation.

In addition to cricket, racquet sports (pickleball, padel, tennis), running, and soccer are all growing quickly in participation. Still, while 70% of young Indians participate in sports, only 10% of adults are active participants. This gap needs to be addressed and is quickly closing due to investment by the public and private sector.

Government support will continue to play a central role in scaling access. Khelo India, a government initiative, now has 1,000+ training centers around the country with a goal of building long-term infrastructure in preparation for a 2036 Olympic bid. The government is also increasing budget allocation towards sports considerably. Moving forward, local community and school-level partnerships will be critical in driving sustained participation.

As support across India improves and participation rates improve as well - athletes, coaches, and facility operators will have more complex needs. There will be increased demand for tools that improve training quality, reduce logistical complexity, and increase access to facilities.

This shift creates a wide range of investment opportunities:

- Personalized coaching and performance tracking platforms

- Discovery, booking, and facility management tools

- Infrastructure access and enablement in underserved regions

Personalized Coaching and Performance Tracking Platforms

As recreational participation in sports grows, I expect Indian consumers to increasingly seek structured, tech-enabled coaching solutions. Several startups have emerged, such as GameTheory and KheloMore, that have proven the demand for digital coaching and discovery platforms. That being said, there is an opportunity to improve personalization as smartphone penetration continues to increase and AI makes individualized training and real-time feedback much more feasible.

Subscription models remain challenging in India due to lower ARPU and consumer resistance, but freemium models and B2B partnerships with schools, academies, and community organizations show promise. Internationally, Strava’s recent acquisition of Runna, an AI-powered platform for personalized running plans, signals growing global interest in this category. A similar approach could be localized effectively for India across a range of sports.

Beyond coaching, there’s a significant opportunity to build a community-first performance tracking platform. India could use a product that looks a lot like Strava and allows users to track progress, build digital communities around their sport of choice, and benchmark performance. India already has deeply built-in social-first behavior and a platform like this could unlock network effects that will allow a company like this to improve monetization, which has been difficult to achieve in India thus far.

Platforms focused on discovery, booking, and facility management

While the demand for coaching and training services will increase in India, there needs to be significant improvement in the tech infrastructure that makes it easy for participation. The process of booking a pickleball court or cricket pitch is highly manual today. Many bookings are done via WhatsApp or through the phone, and there are many facilities that are underutilized due to a lack of participant awareness. Accordingly, facility operators are usually managing their scheduling manually and also don’t have basic payment tools.

There have been several startups that have emerged in this category, but the space remains highly fragmented. I believe there will be a massive business that creates a platform that makes booking courts & facilities easy for participants and scheduling & payments seamless for operators.

For operators: this platform would create tools to manage scheduling, payments, and communication to improve utilization and drive incremental revenue. This platform would make operations seamless, similar to what LeagueApps has done in the US in Youth Sports. For consumers - this would allow for better access and visibility into court / pitch availability and improve participation rates. Over time, this platform could also build in social features similar to what Strava and AllTrails have done.

Beyond private operators, this platform could integrate with public sports facilities or school infrastructure during off-hours when these spaces are unused. These partnerships could rapidly increase inventory while improving community access to sports in a convenient way.

In addition to convenience, a centralized platform would also help standardize quality and pricing across facilities. Today, consumer experience can vary widely depending on location or operator and there is often no formal rating mechanism. Introducing reviews, verified listings, and standardized pricing tiers would help drive trust and repeat usage. Businesses like this have existed in other markets. Playtomic for example is a leading app that connects racquet sports players and clubs.

Infrastructure and access in rural areas

While India’s big cities have significantly improved their sports facilities and infrastructure, there are many parts of rural India that don’t have access to quality coaching and consistent facilities.

Existing fields and courts are not maintained or available during hours when people are most likely to play and as a result millions of potential participants cannot play organized sports. Furthermore, the majority of funds from the Indian government’s initiatives are not going to develop sports in rural areas (see below).

This lack of funding is a big opportunity. Although it is not likely that facilities can be built in every major town, there are ways to create infrastructure that is scalable. Portable pitches, nets, and multipurpose surfaces would bring just the basic necessities to areas that otherwise. Agreements between schools, housing societies, or public spaces could also unlock any inventory that exists today to be used during off-hours without any major capital investment.

Technology will be key to unlocking this. Even a lightweight platform that helps create communities around sport and coordinate group activities in nearby areas could go a long way in improving utilization. As smartphone penetration increases in rural India, digital tools that make sporting facility access more transparent will become increasingly valuable. Ultimately, for India to become the next frontier in participatory sports, the rural population must be addressed.

Emerging sports leagues and recreational participation in sports are just two areas I’m closely tracking in India. India is building a sports powerhouse, and I’m excited to see the many $1B+ businesses in sport that will be built in the country.

If you are operating, investing, or starting any company in India around any of these spaces or adjacent areas, please reach out! I’d love to meet you. Stay tuned for part 2 of this article in the coming weeks, where I’ll talk about the next generation of media, entertainment, and gaming companies coming out of India.